If you’re currently spending more, it can help to sit down together as a family and think about where you can save money.

Your budget will tell you whether you’re currently spending more or less than you earn. Planning how and what to save: a key part of managing money If your income allows, deliberately overestimating the money you need for bills might help you find extra spending money.

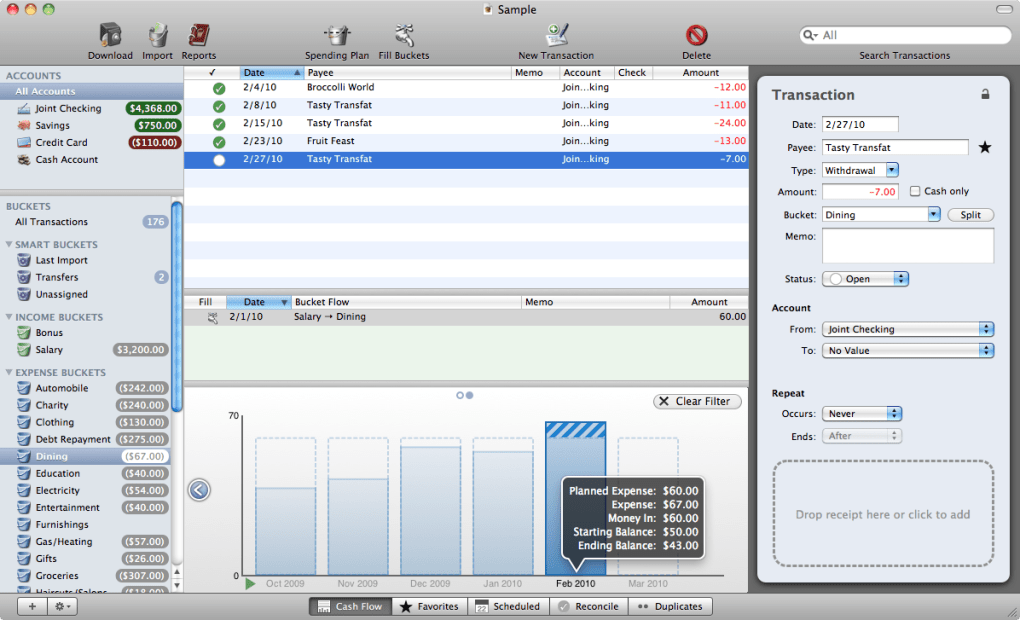

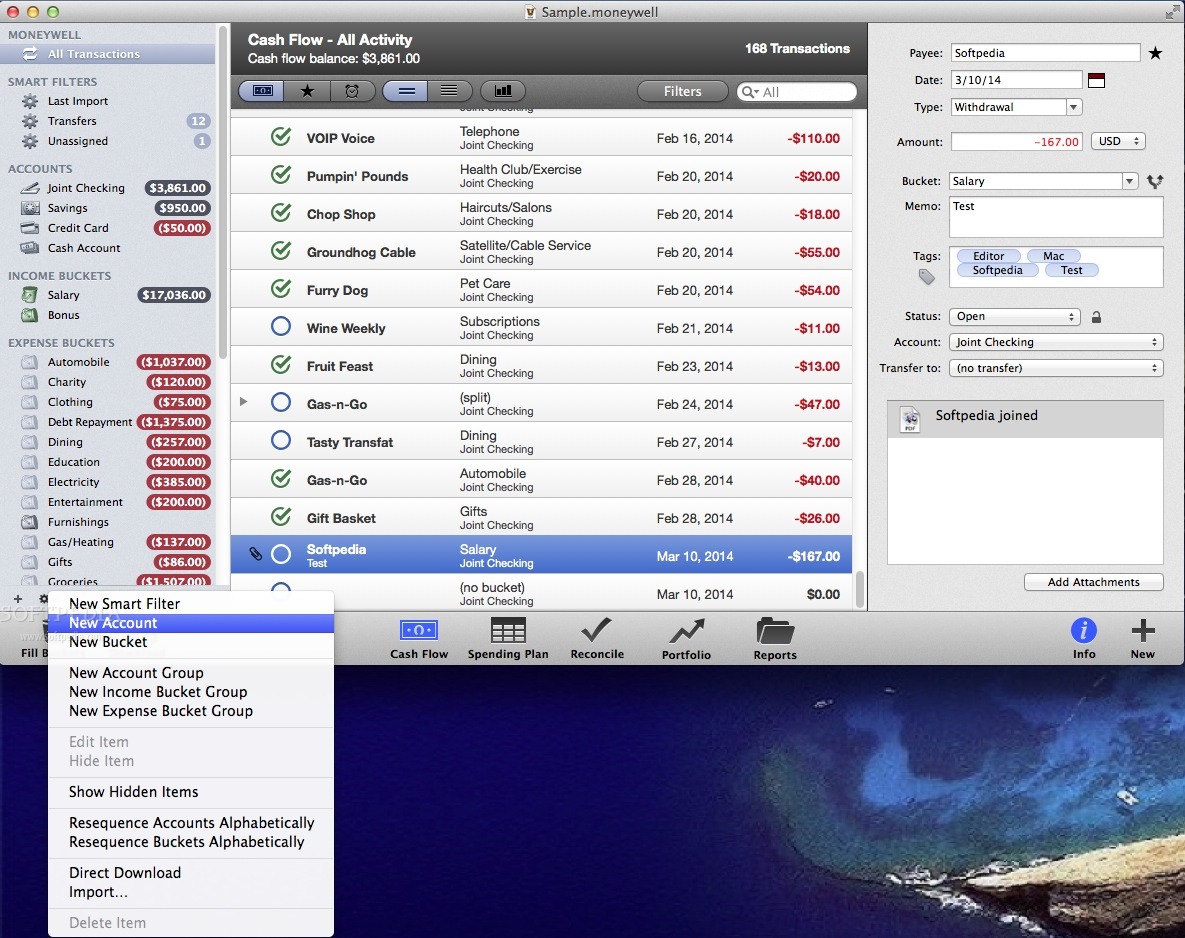

#Moneywell 3 reviews registration

registration fees and equipment – for example, for sports, music or dance programs.personal items like clothing and haircuts.school uniforms, textbooks and stationery.Here are some of the variable expenses you might want to include in your family’s budget: credit card and personal loan repayments.utilities – gas, electricity, water, phone and internet.Here are some of the fixed expenses you might want to include in your family’s budget:

Spending can be regular (fixed expenses) or irregular or once-off (variable expenses). One of the hardest things about making a budget and managing money can be keeping track of what you spend. Working out what you spend: the first step towards managing money

#Moneywell 3 reviews free

You can find many simple, free budget planners online. For example, energy bills are often higher during winter because of heating.Īfter you’ve accounted for essentials and emergencies, your aim is to have money left over to spend on things you want.īudget planners and savings calculators can help you get on top of your family budget. It’s good to look at how some bills are higher at different times of the year. Try to look at enough bills and statements from the past year to understand your usual earning and spending habits. If you spend or earn money any other way, be sure to look at this too. It can help to look at past salary statements, benefit statements, bills, bank statements and credit card statements. One way to start budgeting is to list what you earn, spend money on and owe. The key to budgeting is sticking to a basic rule – spend less than you earn. And it lets you get on with enjoying family life, rather than spending too much time worrying about your finances. Working out how much money you need for everyday essentials like food, housing, utilities like gas, electricity, phone and water, transport and medical services can help you make sure you have enough for unexpected expenses and emergencies.īudgeting can help you and your family take the first step towards control of your money.

set aside money for unforeseen expenses – for example, if your car breaks down and needs repairs.save money for the things you like but can live without – these are your wants.spend your money wisely on the things you must have – these are your needs.That’s because a family budget helps you: A family budget: why it’s a good ideaĪ family budget is essential to managing your money. And involving children in planning and budgeting can make it easier to achieve savings goals together. Honest conversations with your partner, if you have one, can help to avoid conflict about money. It can put you in control of your money, which helps you avoid stress and feel more secure.Ĭommunication in your family plays an important role in managing money well. Basic money management is about meeting your family’s everyday expenses, handling unexpected bills and saving for the future.

0 kommentar(er)

0 kommentar(er)